Homeowners insurance is a crucial investment for protecting one’s most valuable asset—their home. When it comes to choosing an insurance provider, it’s essential to consider factors such as coverage options, pricing, and customer satisfaction. USAA, a well-known provider of insurance and financial services, offers homeowners insurance to military members, veterans, and their families. In this article, Voren will delve into USAA homeowners insurance reviews, exploring customer experiences and satisfaction to help you make an informed decision.

USAA Homeowners Insurance Reviews: Exploring Customer Experiences and Satisfaction

It’s important to note that customer experiences can vary. While many policyholders express satisfaction with USAA homeowners insurance, some negative reviews also exist. Common complaints include occasional delays in claims processing, disagreements over coverage, or difficulties in communication. It’s essential to consider these factors and weigh them against the overall positive sentiment expressed by the majority of customers.

USAA has built a solid reputation for its commitment to serving the military community. With a long history dating back to 1922, the company has established itself as a trusted provider of insurance products tailored to the unique needs of military personnel. USAA homeowners insurance aims to protect policyholders from a range of risks, including property damage, theft, liability, and more.

When examining USAA homeowners insurance reviews, it’s important to consider the experiences of policyholders. Customer reviews provide valuable insights into the quality of service, claims handling, and overall satisfaction with the insurance coverage. By analyzing a diverse range of customer experiences, we can gain a better understanding of what to expect from USAA homeowners insurance.

One aspect that stands out in USAA homeowners insurance reviews is the company’s exceptional customer service. Many policyholders express satisfaction with the knowledgeable and responsive representatives who assist them throughout the insurance process. USAA’s commitment to serving the military community is evident in their efforts to provide personalized attention and support, which resonates positively with customers.

USAA homeowners insurance reviews offer valuable insights into the experiences and satisfaction levels of policyholders. Overall, USAA is highly regarded for its commitment to serving the military community, exceptional customer service, comprehensive coverage options, and efficient claims handling. While some customers mention higher premiums compared to other providers, the majority of policyholders appreciate the value, peace of mind, and financial stability offered by USAA. By considering these reviews alongside your own specific needs and circumstances, you can make an informed decision about USAA homeowners insurance and protect your home with confidence.

Another notable aspect highlighted in USAA homeowners insurance reviews is the comprehensive coverage options available. USAA offers various coverage types, including dwelling coverage, personal property coverage, liability protection, and additional living expenses coverage. Policyholders appreciate the flexibility and peace of mind that comes with having their homes and belongings adequately protected against unforeseen events.

The claims handling process is a crucial factor to consider when evaluating homeowners insurance providers. In USAA homeowners insurance reviews, many customers express satisfaction with the efficiency and professionalism of USAA’s claims department. Policyholders appreciate the ease of filing claims and the promptness with which their claims are processed and resolved. This is particularly important during times of distress when homeowners are seeking timely assistance to recover from losses.

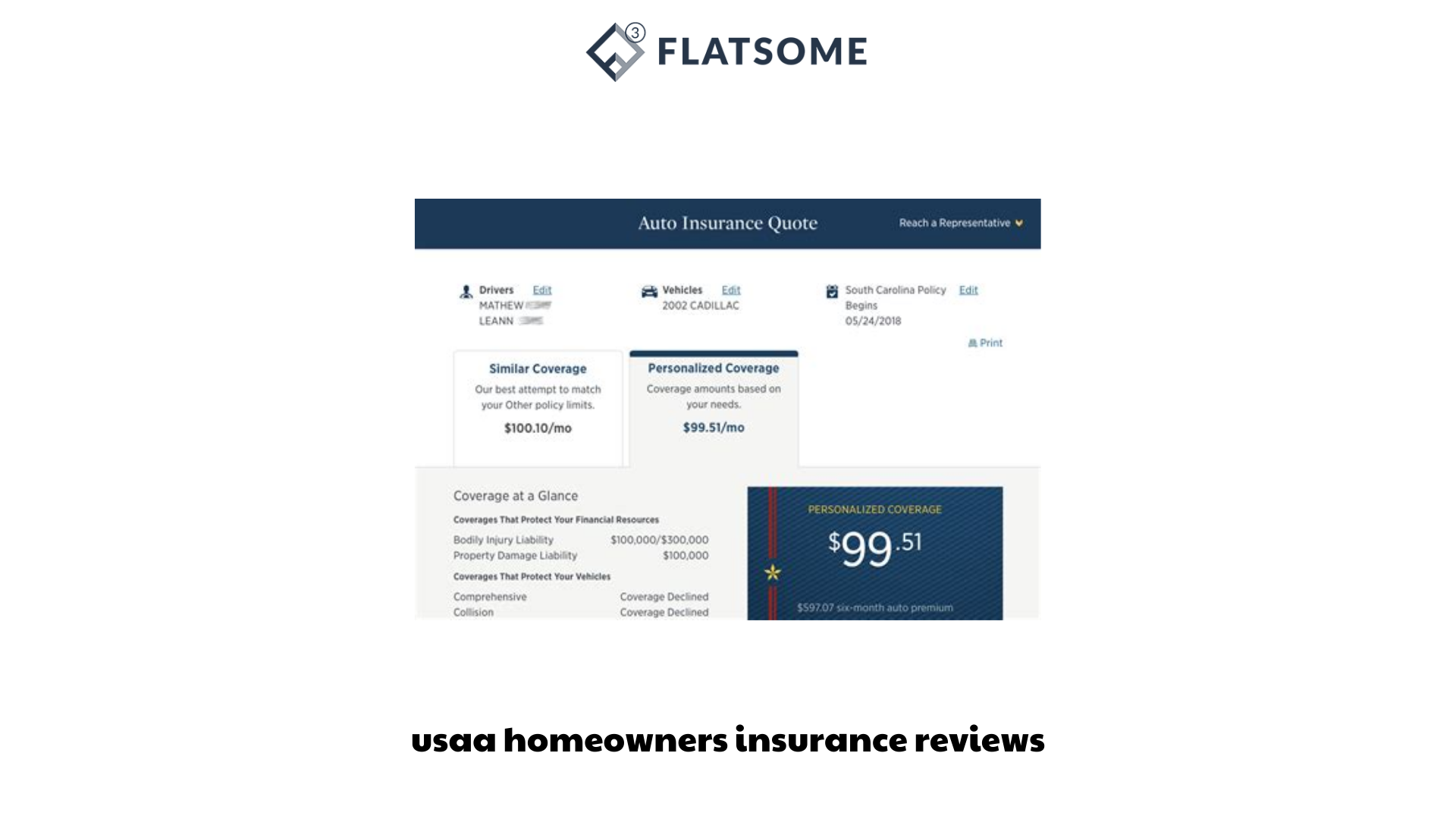

Price is another significant consideration when choosing homeowners insurance. While USAA is known for its exceptional service, some customers mention that the premiums for their homeowners insurance policies can be higher compared to other providers. However, policyholders often acknowledge the value they receive in terms of coverage and customer service, which helps justify the cost.

In USAA homeowners insurance reviews, the financial stability of the company is frequently mentioned as a factor that contributes to customer satisfaction. Policyholders appreciate the peace of mind that comes with knowing their claims will be paid promptly and fairly. USAA’s strong financial standing and high ratings from independent rating agencies reassure customers that the company has the resources to fulfill its obligations.

It’s important to note that customer experiences can vary. While many policyholders express satisfaction with usaa homeowners insurance reviews, some negative reviews also exist. Common complaints include occasional delays in claims processing, disagreements over coverage, or difficulties in communication. It’s essential to consider these factors and weigh them against the overall positive sentiment expressed by the majority of customers.

To make the most informed decision about usaa homeowners insurance reviews, it’s advisable to not only rely on reviews but also reach out to the company directly. Speaking with a USAA representative can provide additional information about the coverage options, discounts, and any specific concerns or questions you may have.

In conclusion, USAA homeowners insurance reviews offer valuable insights into the experiences and satisfaction levels of policyholders. Overall, USAA is highly regarded for its commitment to serving the military community, exceptional customer service, comprehensive coverage options, and efficient claims handling. While some customers mention higher premiums compared to other providers, the majority of policyholders appreciate the value, peace of mind, and financial stability offered by USAA. By considering these reviews alongside your own specific needs and circumstances, you can make an informed decision about USAA homeowners insurance and protect your home with confidence.