As a homeowner, one of the most important financial decisions you’ll make is selecting the right homeowners insurance policy. Homeowners insurance is not just a recommended safeguard – in many cases, it’s a legal requirement. Navigating by Voren the complex landscape of homeowners insurance requirements can be daunting, but understanding the key considerations can help you make an informed choice and protect your most significant investment.

Navigating Homeowners Insurance Requirements

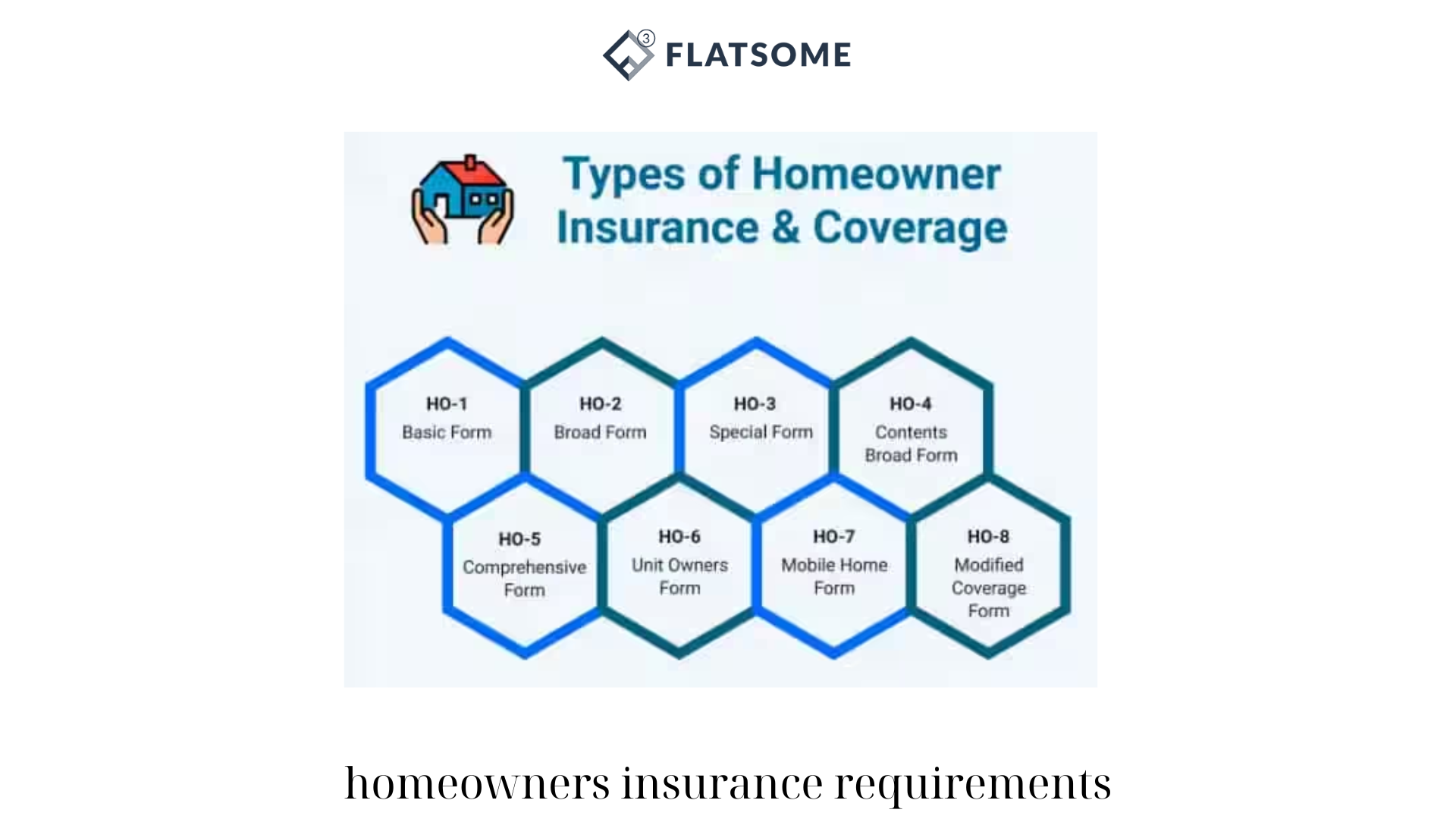

At the heart of homeowners insurance requirements are the minimum coverage levels dictated by lenders, state laws, and homeowner associations (HOAs). Mortgage lenders typically require borrowers to maintain a certain level of homeowners insurance coverage as a condition of the loan. This ensures that the lender’s investment in the property is protected in the event of damage or destruction. The specific coverage requirements may vary depending on the lender, but they generally include at least enough coverage to pay off the outstanding mortgage balance.

Homeowner associations (HOAs) can also play a role in homeowners insurance requirements. Many HOAs have their own set of rules and regulations that homeowners must follow, including specific insurance coverage levels. These requirements are typically outlined in the HOA’s governing documents, and homeowners are expected to comply as a condition of membership. Failure to maintain the required insurance coverage could result in fines or even legal action from the HOA. By understanding the various requirements and taking a proactive approach to selecting the right policy, you can rest assured that your home and assets are protected, even in the face of unexpected events.

In addition to lender requirements, many states have their own set of homeowners insurance mandates. These requirements are designed to ensure that homeowners have the necessary protection in place to safeguard their property and personal liability. The required coverage levels can vary significantly from state to state, so it’s crucial to familiarize yourself with the regulations in your particular jurisdiction.

For example, some states may require a minimum level of dwelling coverage, which pays for the repair or rebuilding of the home’s structure in the event of a covered loss. Others may mandate a certain amount of personal property coverage, which helps replace your belongings if they are damaged or stolen. Liability coverage, which protects you from lawsuits if someone is injured on your property, may also be a mandatory requirement in some states.

Homeowner associations (HOAs) can also play a role in homeowners insurance requirements. Many HOAs have their own set of rules and regulations that homeowners must follow, including specific insurance coverage levels. These requirements are typically outlined in the HOA’s governing documents, and homeowners are expected to comply as a condition of membership. Failure to maintain the required insurance coverage could result in fines or even legal action from the HOA.

Understanding the nuances of homeowners insurance requirements can be complex, but there are several key steps you can take to ensure you’re meeting your obligations:

- Review your mortgage documents: Carefully review the terms of your mortgage agreement to determine the minimum homeowners insurance coverage required by your lender. This information should be clearly stated in the loan documents.

- Research your state’s regulations: Familiarize yourself with the homeowners insurance requirements in your state by visiting the website of your state’s department of insurance or consulting with a local insurance agent. This will help you understand the minimum coverage levels you need to maintain.

- Investigate your HOA’s requirements: If you live in a community with a homeowners association, review the association’s governing documents to identify any specific insurance requirements. Be sure to comply with these standards to avoid potential penalties.

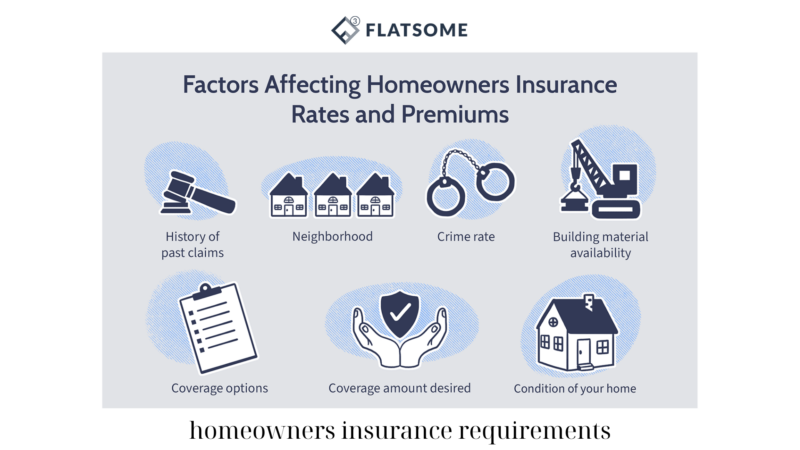

- Consider your personal risk profile: While meeting the minimum requirements is essential, you may want to consider purchasing additional coverage to better protect your home and assets. Factors such as the age and value of your home, the area’s natural disaster risk, and your personal liability concerns should all be taken into account when determining the optimal level of coverage.

- Work with a reputable insurance provider: Partnering with a knowledgeable insurance agent or broker can greatly simplify the process of navigating homeowners insurance requirements. They can help you understand the various coverage options, compare quotes from multiple providers, and ensure that you’re meeting all necessary legal and financial obligations.

Many HOAs have their own set of rules and regulations that homeowners must follow, including specific insurance coverage levels. These requirements are typically outlined in the HOA’s governing documents, and homeowners are expected to comply as a condition of membership. Failure to maintain the required insurance coverage could result in fines or even legal action from the HOA.

Maintaining the appropriate homeowners insurance coverage is not only a legal requirement in many cases, but it’s also a critical safeguard for your most significant investment. By understanding the various requirements and taking a proactive approach to selecting the right policy, you can rest assured that your home and assets are protected, even in the face of unexpected events.